When should you sell a stock?

Buying a stock is often the easy part. You find a company you like, you see a positive trend, and you click “buy.” But for many investors—from beginners to seasoned pros—deciding when to sell is the real challenge. Selling too early means missing out on potential gains; selling too late means watching your hard-earned profits evaporate.

The stock market is driven by two primary emotions: greed and fear. Successful investing requires a disciplined framework that overrides these emotions. In this comprehensive guide, we will explore the strategic, fundamental, and technical reasons why you should consider hitting the “sell” button.

The Psychology of Selling: Why Letting Go Is Harder Than Buying

Before we dive into the data, we must address the mental hurdles. Human psychology is naturally biased against selling, particularly when we are losing money. This is known as Loss Aversion. Research suggests that the pain of losing $100 is twice as powerful as the joy of gaining $100.

This leads to the “Sunk Cost Fallacy,” where investors hold onto a losing stock just because they’ve already invested so much time or money into it, hoping it will “eventually break even.” In the world of finance, the market does not care what price you paid for a stock. Your decision should always be based on the stock’s future potential, not its past performance.

The “Endowment Effect”

We tend to overvalue things simply because we own them. Once a stock is in your portfolio, you might view it through “rose-colored glasses,” ignoring red flags that would prevent you from buying that same stock today. To combat this, ask yourself: “If I didn’t own this stock right now, would I buy it at its current price?” If the answer is a firm “no,” it might be time to sell.

Fundamental Changes: When the Business Story No Longer Makes Sense

The most valid reason to sell a stock is that the original reason you bought it is no longer true. Every investment should start with a “thesis”—a clear explanation of why the company is a good investment.

Loss of Competitive Advantage (The “Moat”)

Renowned investor Warren Buffett often talks about a company’s “Economic Moat.” This is the competitive advantage that protects a company from rivals. If a company’s moat starts to crumble, its long-term profitability is at risk.

-

Examples of a shrinking moat: A tech company losing its lead to a faster innovator, a retail giant being undercut by a new e-commerce model, or a brand losing its cultural relevance.

Management Shifts and Corporate Culture

A company is only as good as the people running it. If the visionary CEO who built the company leaves and is replaced by someone with a track record of poor decisions, the investment thesis has changed. Similarly, frequent accounting scandals, high executive turnover, or a shift toward aggressive, risky acquisitions are major red flags.

Reaching Your Destination: Selling When Your Financial Goals are Met

Investing is a means to an end, not the end itself. You are growing your money for a reason—retirement, a down payment on a house, or a child’s education.

Goal-Based Selling

If you invested in the stock market to save for a house and you now have enough for that 20% down payment, selling is not “giving up” on the market; it’s achieving your goal. It is often wise to move that money into safer, more liquid assets (like a high-yield savings account or a CD) as you get closer to the date you actually need the cash.

Changes in Your Life Situation

Your “risk tolerance” changes as you age. A 25-year-old can afford to see their portfolio drop by 30% in a market crash because they have decades to recover. A 64-year-old planning to retire next year cannot. If your life circumstances change—marriage, children, or approaching retirement—selling volatile stocks to move into “wealth preservation” mode is a sound financial strategy.

Portfolio Rebalancing: Keeping Your Risk Levels in Check

Over time, a successful stock can become a victim of its own success. If you started with a diversified portfolio and one “winner” grows so much that it now represents $40\%$ of your total wealth, you are no longer diversified. You are now heavily exposed to the risks of a single company.

The Rule of Rebalancing

Rebalancing involves selling a portion of your best-performing assets to buy more of your underperforming (but still fundamentally sound) assets. This forces you to follow the golden rule of investing: Buy low, sell high.

| Asset Class | Original Allocation | After Market Growth | Action Required |

| Technology Stocks | 25% | 45% | Sell 20% |

| Bonds | 25% | 15% | Buy 10% |

| Healthcare Stocks | 25% | 20% | Buy 5% |

| Cash/Real Estate | 25% | 20% | Buy 5% |

Financial Red Flags: Detecting When a Company Is in Trouble

Sometimes, the numbers tell a story that the management team is trying to hide. As an investor, you need to keep a close eye on a few key metrics.

1. Declining Profit Margins

If a company’s revenue is growing but its profits are shrinking, it means the company is spending more to earn each dollar. This often happens when a company is forced to lower prices to compete or when its operational costs are spiraling out of control.

2. Rising Debt Levels

Debt isn’t always bad, but too much of it can be fatal. Use the Debt-to-Equity Ratio:

If this ratio is significantly higher than the industry average and is rising every quarter, the company may struggle to pay its interest, especially if interest rates rise.

3. Dividend Cuts

For income-seeking investors, a dividend cut is the ultimate “sell” signal. Companies hate cutting dividends because it signals to the market that they are low on cash. When a dividend is slashed, it’s often a sign of deeper, systemic problems within the business.

Tax-Loss Harvesting: Turning a Losing Investment Into a Strategic Advantage

In the United States and many other jurisdictions, you can use investment losses to your advantage through a strategy called Tax-Loss Harvesting.

If you sell a stock for less than you paid for it, you realize a “capital loss.” You can use this loss to offset “capital gains” (profits) from other investments. If your losses exceed your gains, you can even use up to $3,000 of that loss to offset your ordinary income.

Note: Be aware of the “Wash Sale Rule.” You cannot sell a stock for a loss and then buy the same or a “substantially identical” stock within 30 days. If you do, the tax benefit is disallowed.

Opportunity Cost: When Your Money Could Work Harder Elsewhere

Every dollar you have tied up in an underperforming stock is a dollar that isn’t invested in a better opportunity. This is known as Opportunity Cost.

If Stock A has been stagnant for three years and its future looks mediocre, but Stock B is a high-quality company trading at a massive discount due to temporary market sentiment, selling Stock A to buy Stock B is a logical move. You aren’t just selling to “get out”; you are “upgrading” your portfolio’s potential.

Valuation Extremes: When a Stock Becomes “Priced for Perfection”

Sometimes a company is great, but its stock price becomes detached from reality. This often happens during “market bubbles” or periods of extreme hype.

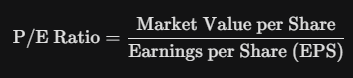

The P/E Ratio (Price-to-Earnings)

The P/E ratio tells you how much investors are willing to pay for $1 of a company’s earnings.

If a stock traditionally trades at a P/E of 20 but is suddenly trading at a P/E of 150 without a massive increase in growth potential, it is likely overvalued. When a stock is “priced for perfection,” even a tiny bit of bad news can cause the price to crash. Selling when the valuation becomes irrational is a classic way to “lock in” profits.

When NOT to Sell: Avoiding the Trap of Market Volatility

It is just as important to know when to stay the course. Many investors make the mistake of selling during a “market correction” (a 10% drop).

-

Market Fluctuations: Stocks do not go up in a straight line. Temporary dips are a normal part of a healthy market. If the company’s fundamentals are still strong, a price drop is often a “buy” signal, not a “sell” signal.

-

Panic Selling: Never sell because “everyone else is selling.” Historically, the best days in the stock market often follow the worst days. If you sell in a panic, you risk missing the recovery.

-

Short-Term Noise: Headlines are designed to grab attention. Don’t sell because of a scary news story about the economy unless that news directly impacts the long-term earning power of the specific company you own.

Developing Your Exit Strategy: The Importance of a Sell Discipline

The best time to decide when to sell a stock is the day you buy it. Before you enter a position, write down your “Exit Plan.”

-

Price Targets: “I will sell half of my position if the stock doubles in price.”

-

Stop-Loss Orders: This is an automated instruction to your broker to sell the stock if it drops to a certain price (e.g., $15\%$ below your purchase price). This protects you from catastrophic losses.

-

Fundamental Triggers: “I will sell if this company’s debt-to-equity ratio exceeds 2.0 or if they lose their largest contract.”

By having these rules in place, you remove the emotional burden of making a decision in the heat of the moment.

Selling is an Art, Not Just a Science

Mastering the stock market requires more than just picking winners; it requires the discipline to walk away when the time is right. Whether you are selling to lock in life-changing profits, to rebalance your risk, or to cut your losses on a failing thesis, remember that liquidity is a tool.

The money you pull out of the market today is the capital you will use for your next great investment tomorrow. Stay focused on your long-term goals, keep your emotions in check, and treat every stock in your portfolio as a business you are proud to own—until the day it no longer earns its place.