Is it worth building a portfolio consisting solely of stocks?

When you start your journey into the world of investing, one of the most common pieces of advice you’ll hear is to “diversify.” Usually, this means mixing stocks with bonds, real estate, or cash. But a growing movement of investors—driven by decades of high-performance data—is asking a provocative question: Is a 100% stock portfolio actually the best way to build wealth?

While the idea of putting “all your eggs in one basket” sounds terrifying, an all-stock portfolio isn’t actually one basket; it’s thousands of companies working for you across the globe. However, this strategy isn’t for the faint of heart. In this guide, we will explore the math, the psychology, and the long-term reality of going all-in on stocks.

Is a 100% Stock Portfolio Right for You? Defining the Strategy

Before we look at the returns, we need to understand what an all-stock portfolio actually looks like. It does not mean betting your life savings on a single tech “moonshot” or a trendy meme stock. A professional all-equity strategy usually involves broad-based Index Funds or ETFs (Exchange Traded Funds) that track the entire market.

When you own a 100% equity portfolio, you are essentially a partial owner of the global economy. If companies make profits, you share in those profits. If they innovate, you benefit.

The Components of a Pure Equity Portfolio

-

Domestic Stocks: Companies based in your home country (e.g., the S&P 500 in the U.S.).

-

International Developed Markets: Established economies like Japan, Germany, and the UK.

-

Emerging Markets: Faster-growing but riskier economies like India, Brazil, or Vietnam.

-

Small-Cap Stocks: Smaller companies with higher growth potential but higher volatility.

Historical Returns: Analyzing the Performance of All-Equity Portfolios

To decide if this strategy is “worth it,” we have to look at the scoreboard. Historically, stocks have outperformed almost every other asset class over long periods.

The Power of the S&P 500

Over the last 100 years, the U.S. stock market has provided an average annual return of approximately 10% before inflation. When you compare this to bonds (historically 4–5%) or savings accounts (often barely keeping up with inflation), the difference in the final “nest egg” is staggering.

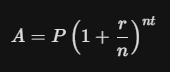

Consider the formula for compound interest:

If you invest $10,000 at a 5% return (a conservative mix) for 30 years, you end up with about $43,219. If you achieve a 10% return (all stocks), that same $10,000 grows to over $174,494. The “all-stock premium” is the price the market pays you for being willing to endure the “roller coaster” of price swings.

The Volatility Factor: Can You Handle a 50% Drawdown?

If the returns are so much higher, why doesn’t everyone go 100% stocks? The answer is simple: Volatility. Stocks don’t move in a straight line. They move in jagged, sometimes violent waves. To earn that 10% average return, you must be willing to watch your account balance drop by 20%, 30%, or even 50% in a single year.

Behavioral Finance: The “Lizard Brain”

Humans are evolutionarily wired to avoid pain. When the stock market “crashes,” your brain signals a state of emergency. This leads many investors to sell at the bottom, “locking in” their losses.

A 100% stock portfolio is only “worth it” if you have the emotional discipline to do nothing when the world feels like it’s ending. If you are the type of person who checks their portfolio every day and loses sleep over a 2% drop, this strategy will likely lead to poor health and poor financial decisions.

Time Horizon: Why Age is the Biggest Factor in Investment Strategy

The “worth” of an all-stock portfolio is almost entirely dependent on when you need the money.

-

The 20-Year Rule: Historically, there has never been a 20-year period where the U.S. stock market has lost money. If your goal is two decades away, an all-stock portfolio is statistically the most likely way to maximize your wealth.

-

The Short-Term Danger: If you need the money in 2 years for a house down payment, 100% stocks is incredibly risky. The market could drop 30% tomorrow and not recover for three years, leaving you short on your goal.

The Retirement “Glide Path”

Traditional financial planning suggests a “Glide Path,” where you start with 90–100% stocks in your 20s and gradually add bonds as you approach retirement. This protects you from a market crash right when you need to start withdrawing money.

Strategic Diversification: Moving Beyond the S&P 500

A common mistake in all-stock portfolios is “Home Bias”—putting all your money into companies from your own country. To truly make a 100% stock portfolio work, you must diversify within the stock asset class.

Why Global Diversification Matters

There are decades where the U.S. market underperforms while International or Emerging markets soar. By owning a “Total World Stock Index,” you ensure that you are participating in growth wherever it happens.

-

Tech Dominance: The U.S. is currently the leader in tech.

-

Manufacturing & Energy: Other regions may lead in commodities or industrial production.

-

Consumer Growth: Emerging markets have growing middle classes that will drive future consumption.

The Missing Pieces: What You Lose When You Skip Bonds and Cash

To understand the value of an all-stock portfolio, you must recognize what you are giving up. Bonds and cash serve as “ballast” for a ship. They don’t make the ship go faster, but they stop it from tipping over in a storm.

The “Dry Powder” Argument

Some investors keep a portion of their portfolio in cash (5–10%) not because they like the low returns, but because it gives them “dry powder.” When the stock market crashes, these investors use their cash to buy stocks at a “discount.” In a 100% stock portfolio, you have no extra cash to take advantage of these opportunities; you are simply “fully invested” and must wait for the recovery.

The Psychological Cushion

For many, seeing a “bond cushion” stay stable while stocks are crashing provides the psychological peace of mind necessary to not sell their stocks. If having 20% in bonds prevents you from panic-selling your 80% in stocks, then those bonds are “worth it,” even if their math returns are lower.

Dividend Investing: Creating Cash Flow from an All-Stock Portfolio

One way to make an all-stock portfolio feel “safer” and more rewarding is to focus on Dividend Growth Stocks. These are established companies that pay out a portion of their profits to shareholders regularly.

The Power of Reinvestment (DRIP)

When you use a Dividend Reinvestment Plan (DRIP), your dividends automatically buy more shares. This creates a powerful feedback loop. Even if the stock price is flat, your number of shares is increasing. Over time, the cash flow from dividends can cover your living expenses, effectively allowing you to “retire” without ever selling a single share of stock.

Common Mistakes in Pure Equities Management

If you decide to pursue this path, you must avoid these three “portfolio killers”:

-

Sector Concentration: Putting all your “stock” money into just “Tech” or just “Energy.” Real 100% stock portfolios should span all sectors.

-

Tinkering: Constantly changing your strategy based on the news. The beauty of an all-stock index strategy is that it requires zero maintenance.

-

Ignoring Fees: High-expense ratios in actively managed funds can eat 1–2% of your returns every year. Over 30 years, that can cost you hundreds of thousands of dollars. Use low-cost ETFs.

Tax Efficiency and the 100% Stock Strategy

From a tax perspective, stocks are often more efficient than bonds.

-

Capital Gains: In many countries (including the U.S.), long-term capital gains (assets held for over a year) are taxed at a lower rate than ordinary income.

-

Qualified Dividends: These also often receive preferential tax treatment compared to the interest earned on bonds or savings accounts.

By holding stocks long-term and not selling, you “defer” your tax liability, allowing your money to compound faster than if you were paying taxes on bond interest every year.

Finding Your Personal Peak

So, is it worth it?

Mathematically, for someone with a long time horizon (15+ years) and a high stomach for risk, a 100% stock portfolio is often the superior choice for maximizing wealth. It harnesses the full power of human innovation and global capitalism.

However, finance is personal. If an all-stock portfolio causes you stress, leads to marital friction, or makes you likely to panic during a downturn, then it is not worth it. The “perfect” portfolio is the one you can stick with for 30 years without changing your mind.

Whether you choose 100% stocks or a 60/40 split, the most important factor isn’t the allocation—it’s the time spent in the market.