Do you know small-cap stocks?

In the vast universe of the stock market, most headlines are dominated by the “titans”—companies like Apple, Microsoft, and Amazon. These are the giants that move the needle of the global economy. However, seasoned investors know that while the giants offer stability, the real “engines of growth” are often found elsewhere. Welcome to the world of Small-Cap Stocks.

If you have ever dreamed of finding the “next big thing” before it becomes a household name, you are looking for a small-cap. These companies are the seedlings of the financial forest. While they carry more risk and can be more volatile than their larger counterparts, they offer a level of growth potential that large-cap companies simply cannot match. In this comprehensive guide, we will explore what small-cap stocks are, why they deserve a place in your portfolio, and how to navigate the risks associated with them.

What is Market Capitalization? Understanding the Foundations

Before we can define a “small-cap,” we must understand the concept of Market Capitalization (or “Market Cap”). Market cap is the total dollar market value of a company’s outstanding shares of stock. It is the most common way to “size” a company in the eyes of the market.

The formula is simple:

The Categories of Size

While there are no hard-and-fast rules, Wall Street generally categorizes companies based on the following ranges:

-

Mega-Cap: Over $200 billion (The Apples and Googles of the world).

-

Large-Cap: $10 billion to $200 billion.

-

Mid-Cap: $2 billion to $10 billion.

-

Small-Cap: $300 million to $2 billion.

-

Micro-Cap: $50 million to $300 million.

Small-cap stocks represent companies that have moved past the “startup” phase and have a proven business model, but they are still in the early stages of their growth trajectory.

Why Invest in Small-Cap Stocks? The Case for Exponential Growth

The primary reason investors flock to small-caps is the potential for massive returns. A company with a $500 million market cap has a much easier path to doubling or tripling its value than a company worth $2 trillion. For a giant like Apple to double in value, it must find another $2 trillion in market opportunities—a Herculean task. For a small biotech or software firm, one successful product launch can send the stock price soaring.

1. The “Small-Cap Premium”

Financial researchers, most notably Eugene Fama and Kenneth French, identified what is known as the “Small-Cap Premium.” Historical data suggests that, over very long periods, small-cap stocks tend to outperform large-cap stocks. This is the “reward” investors receive for taking on the additional risk and volatility associated with smaller companies.

2. Institutional Neglect and Mispricing

Large investment banks and hedge funds often ignore small-cap stocks. Why? Because these institutions manage billions of dollars. If a fund manager wants to take a meaningful position in a company, they might need to buy $50 million worth of stock. For a small-cap company, that might represent 10% of the entire firm, which is difficult to execute without driving the price up significantly.

As a result, many small-cap stocks are not covered by Wall Street analysts. This “neglect” creates opportunities for individual investors to find undervalued “hidden gems” that the big players haven’t noticed yet.

3. Prime Acquisition Targets

Large companies often struggle to innovate internally once they reach a certain size. Their solution? They use their massive cash reserves to buy smaller, more agile companies. When a large-cap company acquires a small-cap, they almost always pay a premium—sometimes 30%, 50%, or even 100% above the current market price. As a small-cap shareholder, you get an immediate windfall.

The Risks of Small-Cap Investing: Navigating the Storm

If small-caps offer such high returns, why doesn’t everyone put 100% of their money into them? Because the road to growth is paved with landmines.

1. High Volatility

Small-cap stocks are notorious for their price swings. It is not uncommon for a small-cap stock to rise 10% one day and fall 15% the next. Because there are fewer shares traded (lower volume), even a relatively small buy or sell order can significantly move the price.

2. Limited Liquidity

Liquidity refers to how easily you can buy or sell a stock without affecting its price. If you own a large position in an obscure small-cap and suddenly need to sell, you might find that there aren’t enough buyers. This can force you to sell at a much lower price than you intended.

3. Business Vulnerability

Smaller companies have less “fat” on their balance sheets. A major economic downturn, a lawsuit, or a failed product launch that a large-cap company could easily survive might be fatal for a small-cap. They often have less access to credit and may struggle to raise capital during tough times.

How to Evaluate Small-Cap Stocks: A Beginner’s Framework

When you are looking at smaller companies, the standard “Large-Cap” rules don’t always apply. You need to look closer at the engine under the hood.

Management Quality

In a small company, the leadership team makes or breaks the business. Look for founders who still have “skin in the game” (owning a large percentage of shares). Research their track record. Have they successfully scaled a business before? Are they transparent with shareholders?

Revenue Growth vs. Profitability

Many high-growth small-caps aren’t profitable yet. They are reinvesting every dollar back into the business to capture market share. While this is normal, you want to see consistent, double-digit revenue growth. If revenue is stagnant in a small company, that is a massive red flag.

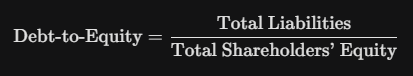

The Debt-to-Equity Ratio

Because small-caps are vulnerable, you want to ensure they aren’t drowning in debt. Use the Debt-to-Equity ratio to gauge their leverage:

A high ratio in a small company can be a recipe for disaster if interest rates rise or if the economy slows down.

Small-Cap Indices: The Benchmarks for Success

To track how the small-cap market is performing, investors look at specific indices.

-

The Russell 2000: This is the most famous small-cap index. It tracks the smallest 2,000 companies in the Russell 3000 Index. When news anchors talk about “small-caps being up,” this is usually what they mean.

-

S&P SmallCap 600: This index is more selective than the Russell 2000. It includes 600 small-cap companies that meet specific liquidity and profitability requirements. Historically, the S&P 600 has slightly outperformed the Russell 2000 because it filters out some of the “junk” companies.

Individual Stocks vs. Small-Cap ETFs: Which Path to Take?

Should you pick your own stocks or buy a “basket” of them?

The Case for Individual Stocks

If you have the time to do deep research, picking individual winners can lead to life-changing wealth. Imagine buying Monster Energy (formerly Hansen Natural) when it was a tiny small-cap; it became one of the best-performing stocks of the last 20 years.

The Case for ETFs (Exchange-Traded Funds)

For most people, a Small-Cap ETF is the better choice. It provides instant diversification. If one company in the fund goes bankrupt, it doesn’t ruin your portfolio because you own 599 other companies.

-

Popular Choice: iShares Russell 2000 ETF (IWM)

-

Popular Choice: Vanguard Small-Cap ETF (VB)

Market Cycles: When Do Small-Caps Shine?

Small-cap stocks don’t perform well in all environments. Historically, they tend to lead the market during the early stages of an economic recovery. When the economy starts to grow after a recession, small, nimble companies are often the first to capitalize on new demand.

Conversely, small-caps often struggle when interest rates are rising rapidly or when there is a “flight to safety.” During times of fear, investors pull money out of “risky” small-caps and move it into “safe” assets like Treasury bonds or Large-Cap “Blue Chip” stocks.

The “Value” vs. “Growth” Divide in Small-Caps

Not all small-caps are the same. They generally fall into two categories:

-

Small-Cap Growth: These are the “glamour” stocks. They are usually in tech or biotech. They have high P/E ratios (or no earnings at all) because investors are betting on their future. They are the most volatile but offer the highest potential.

-

Small-Cap Value: These are companies that are “unloved” or “boring”—think regional banks, small manufacturing firms, or old-school retailers. They often trade at low prices relative to their earnings or book value. Historically, Small-Cap Value has been one of the highest-performing asset classes over long-term horizons (20+ years).

Practical Tips for Your Small-Cap Portfolio

If you are ready to start investing in small-caps, keep these three rules in mind:

-

Keep it a “Satellite” Position: For most investors, small-caps should represent $5\%$ to $15\%$ of their total portfolio. The core of your wealth should still be in more stable assets.

-

Long Time Horizon: Do not invest money in small-caps that you will need in the next 5 years. You need to give these companies time to grow and the market time to recover from inevitable dips.

-

Check Your Emotions: You will see red numbers. You will see $20\%$ drops in a month. If you can’t handle that without panic-selling, stick to Large-Caps.

Small Companies, Big Opportunities

Small-cap stocks are the “frontier” of the stock market. They are where innovation happens, where new industries are born, and where fortunes can be made. By understanding the mechanics of market cap, the importance of diversification, and the specific risks of smaller firms, you can harness the power of these growth engines for your own financial future.

They might be small today, but remember: every giant in the S&P 500 started as a small-cap. The goal of the savvy investor is to find them while they are still small and hold on for the ride.